Medical emergencies could be unexpected, especially for those with a weak financial background burning holes in their pockets and leaning them away from crucial health care. Pradhan Mantri Jan Arogya Yojana (PMJAY), a flagship scheme from the Government of India, secures individuals and families by undertaking health coverage, a necessity in life.

Here in this article, we will explore the multi-layered Ayushman card benefits that you must be aware of to take advantage of the same. It answers exactly why you shouldn’t pass on PMJAY dedicated towards the betterment of society by making them financially stable during such emergencies.

Also Read:12 Healthy And Delicious Fruits For Weight Gain

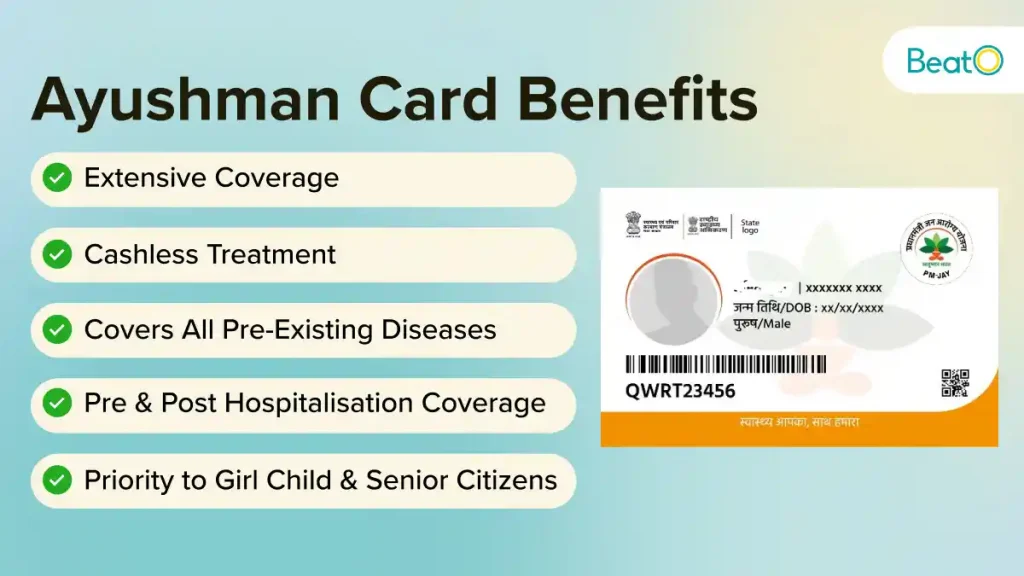

What Are The Ayushman Card Benefits You Mustn’t Miss?

Let’s check out the various benefits that you’d get after subscribing to Pradhan Mantri Jan Arogya Yojana (PMJAY).

Coverage of every needy and deserving

The PMJAY scheme has outlined the types and categories of people covered. It includes households with one room and kucha walls, or SC and ST, or no adults between 16 and 59 years; no male adults between 16 and 59 years; disabled members, those who are landless, and those who do manual casual labour.

On the urban side, it covers people working as domestic workers, ragpickers, sweepers, plumbers, painters, coolies, shop workers, chowkidar, mechanics, a beggar, drivers, etc. Ayushman card benefits those who are truly needy and deserving, allowing the scheme to facilitate a stronger financial backing for medical expenses both pre and post-hospitalization.

Also Read:Amazing Jackfruit Benefits: A Nutrient-Rich Superfood

Healthcare coverage of INR 5,00,000

Nowadays, health coverage is a priority due to rising medical expenses related to OPD, pre-, during-, and post-hospitalization phases. One of the Ayushman card benefits includes health coverage of up to INR 5 lacs for each family eligible for the same. As the central and state governments pay annual premiums in a 60:40 ratio, the coverage is free of charge for eligible families.

Covers all pre-existing diseases

One of the major hurdles when opting for any healthcare policies is they might not cover pre-existing diseases. Even if they do, it will attract a higher premium. With PMJAY, the beneficiaries can enjoy coverage for all pre-existing illnesses and diseases with treatments at public hospitals. It guarantees treatments to all the insured. This includes those who are diabetic or have diabetes for a long time and the coverage starts on day 1 itself.

Also Read:Sugar Free Biscuits Name, Ingredients and Benefits

Cashless treatment

At present, there are more than 60 crore beneficiaries of PMJAY and counting. The scheme offers cashless services across India. It means you don’t have to pay any amount when admitting eligible family members in any impanelled hospitals and up to the aforementioned coverage, the insurance providers will settle the final medical bill with the hospital cashless.

Extensive Coverage

With the Ayushman Bharat Yojana, the beneficiaries can avail a wide range of medical procedures spread across 1,500 medical packages. This includes hospitalization expenses, diagnostics, surgeries, pre and post-hospitalisation costs, etc. The services can be availed across India which makes it convenient for the beneficiary to choose hospitals as per their choices.

The scheme also covers food services, medical implant services, accommodation, laboratory services, medical consumables, complications during any treatments, etc., which ultimately gives the beneficiaries peace of mind as their expenses are taken care of.

Also Read:Beetroot for Blood Sugar | Is Beetroot Good For Diabetes?

Priority to girl child, senior citizens, and empowering women

One of such Ayushman card benefits is the priority it gives to girl children, senior citizens aged 60 and above as well as women. There’s no cap on family size for health coverage. Women beneficiaries can avail maternity care, ailments related to breast cancer, cervical cancer, and any other reproductive health concerns with medical packages enabling them to get required treatments.

Pre and Post Hospitalisation Coverage

With the Ayushman Bharat Yojana, you can avail up to 3 days of pre-hospitalization expenses and 15 days of post-hospitalization expenses. The scheme includes coverage for medicines and diagnostics as well and includes both secondary and tertiary care such as cardiologists and urologist services, cancer treatments, heart surgeries, etc.

Identification and Portability

One of the Ayushman card benefits includes identification of the beneficiaries using Aadhaar cards. Those who are eligible for the same and register for it can also enjoy portability. It ensures that they get required medical treatment from any hospital empanelled in India irrespective of their home location.

Reduced Out-of-Pocket Expenditure

The Ayushman Bharat Yojana offers a tonne of benefits including protection from paying any extra amount towards medical care that either public or private hospitals could charge to the beneficiaries.

Add Read:Soothe Your Smile With These Natural Home Remedies For Tooth Pain

An Unending List of Benefits

The Ayushman Bharat Yojana, as aforementioned, gives you a sum insured value of INR 5,00,000/-. It comes with premiums fully paid by the government, coverage for 9 critical illnesses, and covers both pre and post-hospitalization expenses for 3 days and 15 days respectively. There’s no cap on the family size or gender and in fact, one of Ayushman card benefits empowers women as well as children and senior citizens of India.

Wrapping Up

Pradhan Mantri Jan Arogya Yojana (PMJAY) is one of the largest schemes from the government that ultimately benefits those who can’t afford medical treatments. It includes INR 5 Lacs sum insured for every family with coverage for pre-hospitalization, post-hospitalization diagnostics, and treatment of 11 critical illnesses and beyond that should benefit those who actually need these fully-funded insurance schemes. Check if you or someone you know is eligible for the same and apply for it and stand tall with financial stability during medical emergencies.

Also Read:Bajra Pearl Millets Benefits: Good For Heart & Gut Health

Disclaimer: The content of this article is compiled information from generic and public sources. It is in no way a substitute, suggestion, or advice for a qualified medical opinion. Always consult a specialist or your own doctor for more information. BeatoApp does not claim responsibility for this information.

Disclaimer: The content of this article is compiled information from generic and public sources. It is in no way a substitute, suggestion, or advice for a qualified medical opinion. Always consult a specialist or your own doctor for more information. BeatoApp does not claim responsibility for this information.

Best glucometer sugar testing strips are just one step away from your reach. Try out Doctors’ approved smart glucometer kit and monitor your blood sugar now.